Andrew Cordle: Real Estate Investing Industry’s Up and Coming Star

Andrew Cordle Background and Back Story:

In 2004 Andrew got his real estate investing start and decided that he wanted to bank some coin in the hot real estate market.

So, much like the rest of us, he saw an average Jo featured on an infomercial boasting some big money benjamins and decided he had to check it out.

Obvious next step? Get off his oss and onto making some money, money, money in Real Estate.

So, he tiptoed into his first seminar promoting, you guessed it, millionaire real estate investing.

When it came time, like so many of us,

–he sprinted to the back of the room like Usain Bolt to a room full of female Swedish volleyball players

to drop his $995 entry fee to get the latest tips, tricks and money-maker mojo all wrapped up in a well designed program.

This was it…golden ticket gladness. This was the missing puzzle piece all along.

Ever had that feeling? Yeah, me too. (you can read my story here)

It’s a light bulb moment, picked out of the air by Gru’s gaudy long fingers in Dispicable Me.

The only thing missing is a couple of minions, bananas and the less obvious… real money making possibilities.

‘Cause you find out that the course you just shredded your cash roll on was a perfectly planned pitch poising you to buy into their next DIY RE dinero dealio.

But wait, I thought I was gonna get Kardashian rich on this deal…not a chance, once you have been sucked dry, you will still have to come up with some money for your actual real estate business.

So… I say…

Screw the “no money, no credit, no sense…and still make big bucks blasting out business deals concept.”

(There’s a better way, you can check it out here. Thanks to my meeting James at just the right time.)

Your business is gonna big time cost you. Not only does it cost you on the front end in finding, financing and flipping, but while you are going cash crazy, your bucket is leaking from the bottom end, paying for the fact that you quit your job and you got bills, lots of bills.

It’s like a game of twister with a greased octopus, no matter how good you can move, you’re gonna get inked.

Alright, enough bashing the RE. The Real Estate Spy’s gotta get back you back on task with your research.

Back to Andrew Cordle…

He started with one house and was able to make almost $30,000 in his first transaction. Of course he practically had his whole fam doing hard time in the flip.

Gotta love good ole mom and dad. He is obviously quite a leader if he can get his family to pitch in to help him do his first deal at 23 or 24 years old. Either that or they wanted him out of the house on his own. LOL

Yeah I had a boomerang brother that bought into the real estate mogul magic, tried to help him out a couple of times.

But, in a stroke of sheer Vegas Vacation luck, he scored on his first deal, exposing a nimble knack for making a nickel hiden in this rising star.

He was able to flip his first home in 90 days.

Once bitten….He was ready to scale up his business.

Like a Lays potato chip, he decided he couldn’t just have one and quickly ramped up his portfolio to lots of houses.

The second one that he bought, fixed and flipped was an average Atlanta abode. But by his 3rd, he was ready to go blue chip. He decided to bight off a humongo-django chunk of potential paradise by purchasing a house worth $1.5 million. 10 bedroom, 15,000 square-foot home, but at the end of that one, he was feeling pretty punked. It was a lapse in progress, and he learned a lot, but wouldn’t pull that maneuver again.

These three houses were his training ground and he decided to ramp up his production further. He proceeded to purchase up to six homes per month. He also changed the way that he did rehabs.

He increased the rehabs from simple painting and cosmetic rehabs to major overhauls. Once his business after-burners kicked in, he didn’t think twice about tearing down and building new.

He ferociously began to manage 20 or 30 properties at a time.

He admits that he jumped into the deep end of the pool and left his orange floaties at home.

He also does not recommend that other people do it the way he did it. What’s more…it has become his raison d’etre (reason to live). It has also become the reason for his Internet business podcasts and everything else that is going on. He claims his goal is actually to help other people avoid a lot of the pitfall mistakes that he made when he first started out.

But more of that later.

As he tells the story youth got the best of him. He said at 24-25 years of age he was making $20,000- $40,000 per property, and at 20-30 properties per month….put your math cap on. He even raked in $272,000 on one transaction.

His parents were teachers and so they never had a lot of money.

So, coming into new money he was like a squirrel on crack, mismanaging the fruit of his labor. He vacationed like a VIP on a Richard Branson Budget.

He even bought a house for himself with an elevator. He chuckles at himself now….why would a 23-year-old need an elevator?

Living the good life caught up with him.

He quickly grew his organization and owned a major enterprise doing millions of dollars per year. However in 2007- 2008 the real estate market bit the big one unexpectedly, and his over confident business skills left him blind to what was coming. He was too busy spending his money as he says it.

He went from 22 employees down to two or three employees. He got stuck with 14 properties that he could not sell. The money train has left the station, and without consistent cash flow, he went into default.

If you want to see who has leverage in the real estate game, just go into default. It gets ugly fast.

He was spending $2,000-$2,500 per month per property.

Unfortunately because of the senseless spending he did not save a lot. He was blowing through savings at the rate of $30,000-$40,000 a month.

He ended up having to turn all of those properties back over to the bank. He lost all his properties and he lost all his money.

Shoot I know what that’s like. It might sound sadistic, but I remember turning in the keys to one of the properties I owned, and it felt fantastic.

It was like handing a bowl of soggy corn flakes back to the kitchen cafeteria lady in the black hairnet back at the old elementary school.

I mean, it looked nasty, but it felt good once it was out of my hand.

So Andrew found it in himself for one last hurrah back to his Hawaiian honey pot in Maui.

It was the last time, and it opened the door to the final blow to his ego…

What he didn’t know was while he was gone, his wife made an exodus too. When he returned, she was gone.

Demoralized, he had lost his business, his benjamins, and his bride. His credit, Cadillac and cashflow…his employees, his real estate… everything that he had amassed over the previous few years…gone!

He ended up moving back in with his parents and living in their basement.

He was broker than a tooth fairy in a house full of Meth addicts.

A couple of years later he had the gumption to go ahead and start back into real estate. In 2010, he started a new business with a new mindset. He basically says that the good thing with real estate is that it doesn’t matter if you have failed at it as long as you know it. Because the rules of the game really don’t change all that much. The economy might, but Real Estate doesn’t.

He emerged out of the wake of it all smarter. Now he believes in building a safety net for everything he does.

Introducing the New and Improved Andrew Cordle with almost 1000 real estate transactions by the time he was only 30 he flipped and almost 100 homes in 12 months.

He has been seen on CNN, A&E and Fox. 10 years in the industry, he has become the flip go-to-guy.

IFlip UFlip Podcast by Andrew Cordle

So what is Andrew really up to? What I see is a young man who displays all the inner-workings of an entrepreneur.

Word has it that he struck a deal with Home Depot. This tells me that he is ready to create a brand and more endorsement deals. Think of people like Dave Ramsey. You probably have heard of him. As a matter of fact, he has a similar story to AC as well. He endorses tons of things that he makes money on: from investing using mutual fund research software to identity theft prevention, he is a master marketer.

Basically these individuals build a brand all to themselves. The idea is that you create an online persona and then get followers.

That is the brilliance of this podcast. Basically if he provides enough free information and creates value for his listeners, then they’ll feel like they get to know him. They will get so used to taking his advice that they will accept lots of things that he recommends including…you got it… Home Depot. This may include buy more stuff at Home Depot or buying his books and CDs.

We are back to the concept of expose, involve, and upgrade.

The bottom line is that he is masterfully putting together his branding online.

I’m not gonna say anything bad. As the real estate spy, I’m only here to report on what I can see going on. Yeah, I’d pull the curtain back on the wizard of oz, but I’m not here to bad mouth anyone.

I like what I see. He’s got a big vision, and I’ve listened to his podcasts. They are golden.

Andrew provides a nice “beginner’s blueprint” overview of what he would suggest that people do if they decide to start doing real estate investment for a living.

In summary, he tells people what he’d do if he had to start all over again.

He has a list of 5 “musts” to create a firm foundation.

1. Join all the local REIAs (not just one). He would also suggest that you attend them on a regular basis. This is important because of the networking involved. Oh yeah, and don’t dabble in the drama in those places. Stay out of that stuff.

2. Get involved in meet ups. Network with people.

3. Avoid Shiny object syndrome. Don’t fall into the trap of buying all kinds of new products, gadgets and training materials that are supposedly the key to your real estate success. Just make sure you buy his book, “wink.”

4. Join Bigger Pockets (Online Forum and Information Resource). Get involved in their events.

5. Search for Wholesales in the market. Make a separate email address so you can join lists of wholesaler to see what is out there on the market. Once you see some things you like, contact them using your normal personal info. He says the best way to do this is actually to research homes for sale on craigslist. Specifically you were looking for a fixer-upper’s and handyman specials. He said then you go to their site and register with the email address that is not your primary email address. Most wholesalers will have a buyer’s and seller’s list. Then you can sit on their list and see what types of real estate comes through. Later if you decide that you want to contact him then you can use your regular email address. This keep your personal protected info confidential and allows you to get involved when you’re ready. I think this is brilliant tip. A lot of people forget about the power of craigslist. There is so much that you can do based on the information that you find there.

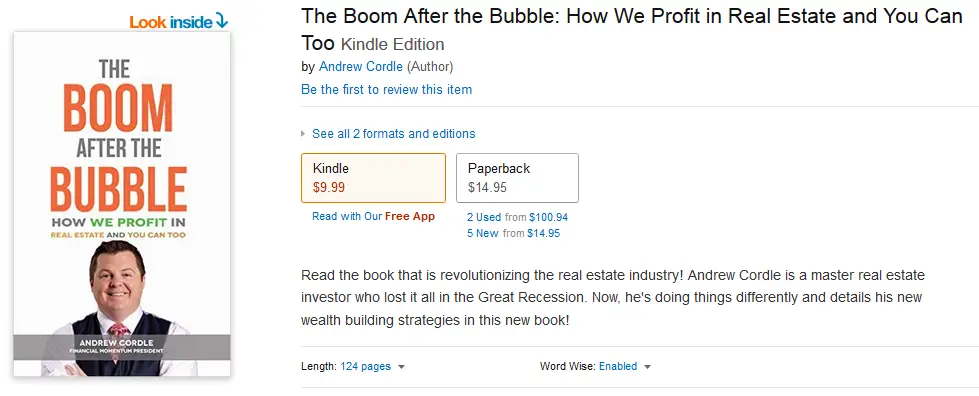

Andrew Cordle (Author) Books:

The Boom After the Bubble: Andrew’s new book:

This book is dedicated to talking about the cycles of real estate. He drops the ups and downs on you like a dirty rag.

He sucks out some of the glamour of the real estate market in real estate investing and gets real with you. He shares about his highs and lows. The book is designed to help you recognize trends in your own business and learn how to cope with them.

It also talks about how to make money in real estate and encompasses three significant components.

Creating capital

Creating change

Creating cash flow

——-

Business Survival is about building a business in real estate in today’s market.

What Andrew discusses in this book is that it’s not always great inside of business and especially not always great inside of the real estate business.

I believe this is one of the most practical authors I’ve come across here. He gets down to the nitty-gritty of the fact that there is a fantasy that is propagated out there (easy real estate riches) living the life of an investor and not having to work for someone else for the rest your life.

He is great at exposing the downfalls of the real estate business.

This book covers 20 different survival techniques that you can use in order to hold your own real estate and make a profit.

He also spends time talking about what will happen to your business when it starts expanding.

Many years ago my accountant told me if I wanted to be in the real estate business then I’d better make sure that I didn’t have just one property. He said you need to have multiple properties.

It doesn’t make sense just to have one. And it is clear that you will not make a fortune on one property alone. I think this is really important to realize as you are getting into real estate investing because you are going to have to make sure that you’re expanding your business continually.

In this book Andrew talks about the pitfalls that you encounter once you move from the onsie, twosie deals and proceed to having multiple properties and projects going at the same time.

It can be cut throat, and exhausting. This is what he wants to help you learn.

Mr. Cordle Real Estate Investor Guru Summary:

At first glance I wondered if this was just simply a don’t buy anybody else’s stuff just mine pitch, but with Andrew’s free podcasts and so much free information on his website I believe that he is branding himself to become the next Internet real estate guru but with the intention of creating a following and making his money from the endorsements he attracts.

Andrew Corble has really made a name for himself. At this time I did some research on him also on Google to see how many people are searching for him each month. Currently it is about 170 people. This tells me that he is a rising star. I believe the next 5 to 10 years he will be a mega mouthpiece for real estate investing trends and tips.

You have to understand that he has created his own online marketing company at the same time he’s building his real estate business.

It is important to understand that you don’t just come across his information by happenstance. Everything is a well oiled machine and he is creating an online presence that gets you involved.

Whether you are listening to his podcast, reading his blog, or buying his books, you’re being exposed to who he is and are a potential lifelong customer for him.

Does he have sound advice?

I’d say so. He does spend a lot of time marketing his story.

The story is that he failed and now he is succeeding. The story is really important in order for you to relate to them.

It brings him down to earth and answers the question, “Why should you listen to him.”

One of the things that he does a good job at is providing a lot of videos on his website. You get to see some of his handiwork and it gives you an idea of what type of individual he is. I can say with certainty that he’s committed to excellence and a very driven fellow.

One of the key points I’d like to drive home is that you have to be willing to work, take risks and talk to people. I think this is great because he encourages you to get out there and actually talk to people. In the real estate investing market I don’t see a way to simply push a button and make riches.

Once you step into the real estate investment world, you are going to be busy. If you’re not busy, then you are not making money. Now that sounds intuitive, but my point is really that if you are not taking huge action, such as sending out lots of mailers or connecting with people, you will not be making money.

I believe there is an easier way. You can check out some spy videos I uploaded here from James, my mentor and coach.